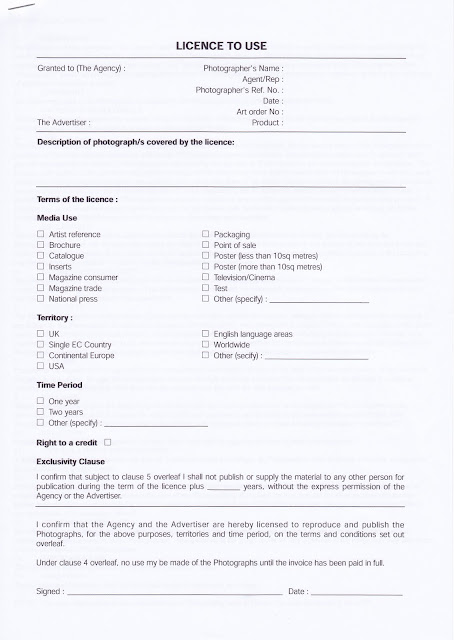

This form grants rights over the use of photographs for a specified purpose, period and in a specified territory. If the client breaches the terms of the licence the photographer can issue an additional invoice for further charges. An exclusivity clause can be included to grant the client exclusive use for the licence (or other agreed) period ie the photographer cannot sell the images to anyone else during this period. The licence agreement should be counter signed by the client.

This article from the Redeye website (http://www.redeye.org.uk/) gives an overview of licensing:

Copyright and licensing is explained in more detail in this 2 page article taken from http://www.jkeenan-photo.demon.co.uk/pdf/Copyright%20Explained.pdf

More information on copyright is available from the UK Copyright Service: http://www.copyrightservice.co.uk/

Many forms of licence agreement are available. Here are 3 examples:

This third example, for use by a freelance photographer, together with the terms and conditions, were taken from the AOP website http://hub.the-aop.org/

An estimate template can be used to cost a job so for a client and also so the photographer knows how much the job will costs and can consider whether it is worth taking the work on.

This template is from the AOP website as above:

Again this is really aimed at a freelance photographer. Below is a simpler version of an estimate template from Microsoft templates - http://office.microsoft.com/en-us/templates/CT101172551033.aspx, which could be used for one-off/custom shoots in our boudoir studio:

3. An invoice template

An invoice is issued as a request for payment, usually on completion of the job, although in some cases stage payments or payment in advance may be requested.

Again from the AOP for freelancers:

and a simpler version from Microsoft:

The templates on Microsoft are available for free download. It is also possible to buy templates from websites such as Clickdocs - http://www.clickdocs.co.uk/. You could also design your own invoices and the document below (from Clickdocs) advises on what information must be included on an invoice:

The business terms and conditions (T&C's) should also be provided to customers (usually printed on the back of an estimate and/or invoice). The website http://www.payontime.co.uk/ gives advice about what should be included within your terms of trade, together with advice about debt collection.

Pro-forma T&C's will be added to the blog later.

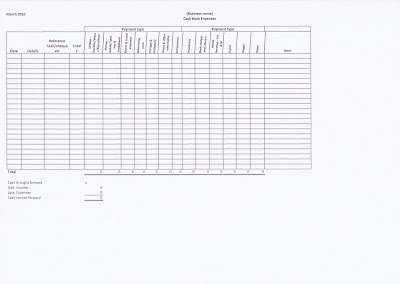

4. A book-keeping template.

The document below, from fastlinksolutions (http://www.fastlinksolutions.co.uk/bookkeea.htm) sets out some basic book-keeping tips:

A really good site for information on starting up a business is http://www.businesslink.gov.uk/. One area it includes is how to set up a basic record keeping system:

a) Cash receipts

b) cash book expenses

If you don't have Excel a free donwload of a spreadsheet package is available from http://www.openoffice.org/.

Further advice and information

Apart from those mentioned above, there are many other sources of information on starting a buisness including:

Books, eg Beyond The Lens published by the AOP and The Small Business Start-up Work Book by Charyl D. Rickman.

The Blackburn Chamber of Commerce http://www.blackburnchamber.co.uk/

Banks, eg http://www.natwest.com.business.ashx/

Websites, eg Business start up http://www.startups.co.uk/ and Photo.net www.photo.net/learn/ (covers the lifecycle of a freelance job including estimating and billing) and PWD Labs http://pwdlabs.wordpress.com/category/photography-industry/the-business-of-photography/ (a blog covering various business planning matters)

HM Revenue and Customs www.hmrc.gov.uk/index.htm

No comments:

Post a Comment